Table of Contents

The cryptocurrency market is expected to expand by USD 34.5 billion between 2024 and 2028 due to an increase in investments in digital assets. Technavio report on AI's influence on market trends

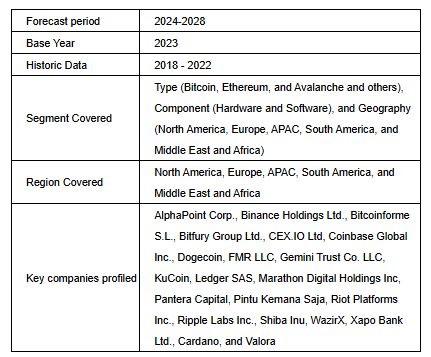

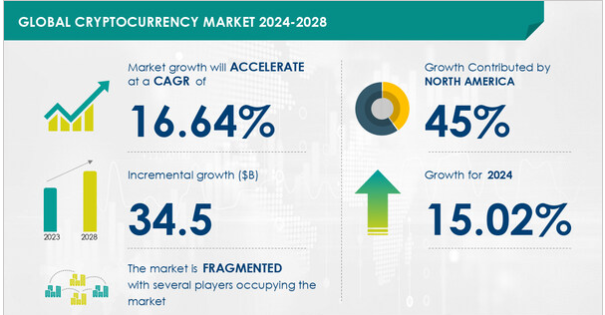

The cryptocurrency market is expected to expand December 15, 2024, New York /PRNewswire — An analysis of how AI is changing the market environment According to Technavio, the size of the global cryptocurrency market is expected to increase by USD 34.5 billion between 2024 and 2028. Over the course of the projected period, the market is anticipated to expand at a CAGR of 16.64%. The market is expanding due to rising investment in digital assets and a trend toward retailers accepting cryptocurrencies. The difficulty, though, is the cryptocurrency’s value volatility. Coinbase Global Inc., Dogecoin, FMR LLC, Gemini Trust Co. LLC, KuCoin, Ledger SAS, Marathon Digital Holdings Inc., Pantera Capital, Riot Platforms Inc., Ripple Labs Inc., Shiba Inu, WazirX, Xapo Bank Ltd., Cardano, and Binance Holdings Ltd. are some of the major market participants. The cryptocurrency market is expected to expand

the major market participants.

Important Market Trends Driving Development

For routine transactions, the public, retailers, and merchants are increasingly using cryptocurrencies like Bitcoin and Ether. The public’s opinion of cryptocurrencies and their use in financial transactions improved in 2022 when big shops, such as Starbucks, began to accept them. Starbucks presently converts cryptocurrencies to cash through partnerships with third-party exchanges. Starbucks started accepting NFTs and cryptocurrency purchases in April 2022. Cryptocurrencies are accepted for a variety of transactions by businesses like AT&T, Microsoft, PayPal, and Tesla.Bitcoin is accepted by Microsoft for digital goods and services. For Bitcoin bill payments, AT&T employs the BitPay processor. A website called EGifter allows users to buy gift cards using Bitcoin and other cryptocurrencies. Because they increase more quickly than inflation, cryptocurrencies like Bitcoin offer businesses a worthwhile way to save money. Cryptocurrency acceptance as a backup payment option is essential for small enterprises and shops in case of unforeseen events and market expansion. The cryptocurrency market is expected to expand

Digital currencies built on decentralized technology known as blockchain are known as cryptocurrencies, and they include Bitcoin and Ethereum. This technology eliminates the need for middlemen and enables safe, transparent transactions. Global adoption of cryptocurrencies is on the rise, but price volatility remains a concern. The risk of theft and cybersecurity are serious issues, and regulatory perspectives differ globally. Debate surrounds energy use and its effects on the environment. In current digital age, financial services have a significant demand for skilled developers. Financial stability and consumer protection are essential. Investment opportunities are provided by digital assets, but watch out for fraud and scams.A sustainable future depends on blockchain talent and renewable energy. Secure transactions on public ledgers are guaranteed by cryptography and decentralized systems. Altcoins, mining, digital wallets, encryption, trading, brokers, and cryptocurrency exchanges are essential components of this market. Wire transfers and ACH transfers are examples of fiat currency payment mechanisms. Different levels of protection are provided by hot wallets and cold wallets. Watch out for fraud, romance scams, and cryptocurrency frauds. Investment vehicles include mutual funds and bitcoin trusts. The cryptocurrency market is expected to expand

Market Challenges

Due to the substantial power exercised by a small group of investors who trade in large quantities on platforms and exchanges, the bitcoin market is known for its tremendous volatility. Bitcoin’s value fell 10% in a single day in June 2022 from its peak of USD69,000 per token in November 2021. There were also drops of more than 15% in other digital currencies, including Dogecoin and Shiba Inu. This volatility is exacerbated by the lack of rules and fees on trading platforms, which enables wealthy shareholders to manipulate value for financial gain. Because of these concerns, major investors like Accel, Ribbit Capital, and Insight Partners have decided not to incorporate cryptocurrencies in their portfolios, which could impede the market’s expansion.Significant declines in the value of several cryptocurrencies were caused by the recent regulatory statement in one nation, which made the market even more unstable. The cryptocurrency market is expected to expand

Digital assets like cryptocurrencies provide financial innovation, but they can present difficulties. Price fluctuation raises concerns about financial stability. Risks arise from scams and fraudulent investments. The keys to growth are blockchain talent and renewable energy. Secure transactions on the public ledger are guaranteed by cryptography and decentralized systems. The market is expanded by digital wallets, mining, and altcoins. Brokers and bitcoin exchanges are necessary for encryption and trading. Common payment methods include wire transfers and ACH transactions in fiat currencies. While frozen wallets provide security, hot wallets provide convenience. Investors are at risk from fraud, romance scams, and cryptocurrency frauds.Bitcoin trusts, mutual funds, and blockchain stocks offer investment instruments. Use is expanded by luxury items, insurance payments, e-commerce, and bitcoin debit cards. Security is essential, and decentralization and encryption offer answers. The cryptocurrency market is expected to expand

With a market valuation of over USD 470 billion, Bitcoin is the most popular cryptocurrency. It is a digital currency that functions independently of centralized authorities. With 95% of interested parties aware of its existence, its peer-to-peer (P2P) transfer technology has becoming increasingly popular worldwide. Bitcoin has a significant amount of market dominance; its market capitalization more than doubles that of Ethereum. Pegged to the US dollar, Tether, USD Coin, Binance USD, and DAI are some of the top 20 cryptocurrencies. Approximately 8 percent of people in the US trade cryptocurrencies. The blockchain, the decentralized system behind Bitcoin, keeps track of every transaction on a public ledger, guaranteeing security and transparency. The global cryptocurrency market is growing thanks in large part to its unique features and broad adoption. The cryptocurrency market is expected to expand

Frequently Asked Question

The cryptocurrency market is expected to grow by USD 34.5 billion between 2024 and 2028, with a compound annual growth rate (CAGR) of 16.64%, according to a Technavio report.

The market is expanding due to rising investments in digital assets, increased acceptance of cryptocurrencies by retailers, and their utility in routine transactions. Additionally, partnerships with third-party exchanges and the use of blockchain technology have contributed to this growth.

Major challenges include price volatility, regulatory uncertainty, cybersecurity risks, environmental concerns related to energy use, and the potential for fraud and scams. These issues have made some investors cautious about including cryptocurrencies in their portfolios.

Businesses like Microsoft, Starbucks, PayPal, Tesla, and AT&T are accepting cryptocurrencies for various transactions. They often rely on third-party processors to convert digital assets into fiat currency for ease of use. Small businesses also see cryptocurrencies as a backup payment option for market expansion and stability.

Blockchain technology underpins cryptocurrencies by enabling secure, transparent transactions without intermediaries. It uses cryptography and decentralized systems to ensure data integrity and provides opportunities for innovation in financial services.

You can also read about cryptocurrency from our website.

myselfcrypto || insightbitmarket || truthofcrypto || buybitmarket || defidiary || tweetcrypto || cryptocosmosworld

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  Sui

Sui  Chainlink

Chainlink  LEO Token

LEO Token  Avalanche

Avalanche  USDS

USDS  Stellar

Stellar  Toncoin

Toncoin  Shiba Inu

Shiba Inu  WETH

WETH  Litecoin

Litecoin  WhiteBIT Coin

WhiteBIT Coin  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Hedera

Hedera  Monero

Monero  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Polkadot

Polkadot  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Uniswap

Uniswap  Pepe

Pepe  Aave

Aave  Pi Network

Pi Network  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  OKB

OKB  Aptos

Aptos  Bittensor

Bittensor  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Jito Staked SOL

Jito Staked SOL  NEAR Protocol

NEAR Protocol  Internet Computer

Internet Computer  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Ondo

Ondo  sUSDS

sUSDS  USD1

USD1  Mantle

Mantle  Gate

Gate  Tokenize Xchange

Tokenize Xchange  Cosmos Hub

Cosmos Hub  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  VeChain

VeChain  Official Trump

Official Trump  Arbitrum

Arbitrum  Lombard Staked BTC

Lombard Staked BTC  Sky

Sky  POL (ex-MATIC)

POL (ex-MATIC)  Render

Render  Ethena

Ethena  Filecoin

Filecoin  Quant

Quant  Algorand

Algorand  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Sei

Sei  Binance-Peg WETH

Binance-Peg WETH  Worldcoin

Worldcoin  USDtb

USDtb  KuCoin

KuCoin  Binance Staked SOL

Binance Staked SOL  Jupiter

Jupiter  USDT0

USDT0  NEXO

NEXO  Rocket Pool ETH

Rocket Pool ETH  TNQ

TNQ  SPX6900

SPX6900  Bonk

Bonk  Polygon Bridged USDT (Polygon)

Polygon Bridged USDT (Polygon)  Fartcoin

Fartcoin  Injective

Injective  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Stacks

Stacks  Sonic

Sonic  Celestia

Celestia  Pudgy Penguins

Pudgy Penguins  Virtuals Protocol

Virtuals Protocol  Optimism

Optimism  PAX Gold

PAX Gold  Mantle Staked Ether

Mantle Staked Ether